Tax Increment Financing (TIF) is a financing option that allows a municipality (town, village or city) to fund infrastructure and other improvements, through property tax revenue on newly developed property.

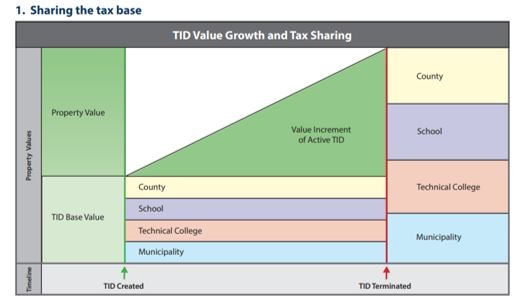

A municipality identifies an area, the Tax Incremental District (TID), as appropriate for a certain type of development. The municipality identifies projects to encourage and facilitate the desired development. Then as property values rise, the municipality uses the property tax paid on that development to pay for the projects. After the project costs are paid, the municipality closes the TID. The municipality, schools, county, and technical college are able to levy taxes on the value of the new development.

When a municipality creates a TID, the municipality and other taxing entities agree to support their operation from the existing tax base within the TID. They agree the municipality will use the taxes on the value increase in the TID to pay for the investment.

Village of Harrison's Tax Increment District Map

TID #1 Project Plan(PDF, 3MB)

TID #2 Project Plan(PDF, 3MB)

TID #3 Project Plan(PDF, 2MB)

TID #4 Project Plan(PDF, 2MB)

TID #5 Project Plan(PDF, 1MB)

TID #5 Amended Project Plan(PDF, 6MB)

TID #6 Project Plan(PDF, 3MB)